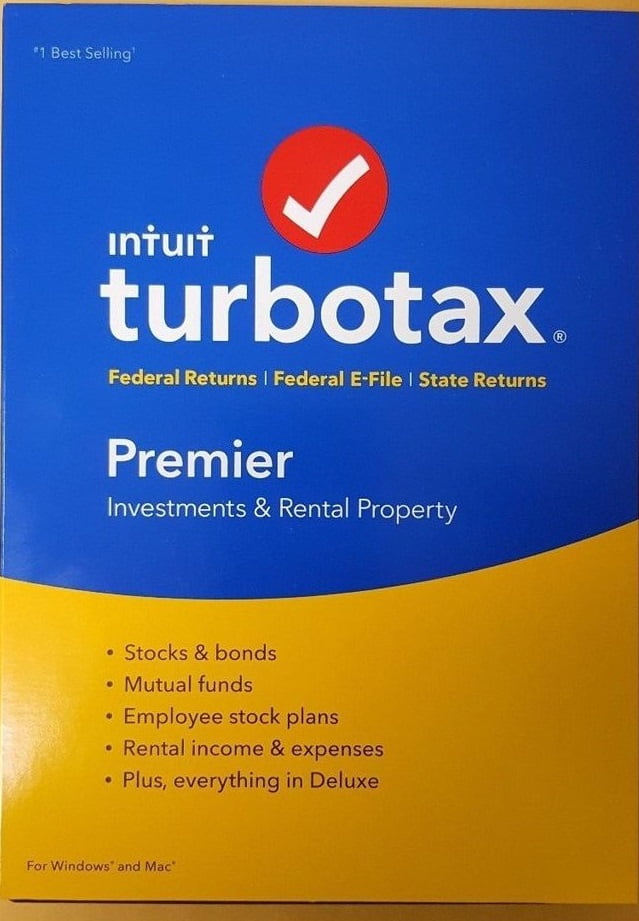

- WALMART TURBOTAX PREMIER 2018 FULL

- WALMART TURBOTAX PREMIER 2018 SOFTWARE

- WALMART TURBOTAX PREMIER 2018 PROFESSIONAL

- WALMART TURBOTAX PREMIER 2018 DOWNLOAD

(TurboTax Free Edition customers are entitled to payment of $30.) Excludes TurboTax Business. If we are not able to connect you to one of our tax professionals, we will refund the applicable TurboTax federal and/or state purchase price paid. We will not represent you before the IRS or state agency or provide legal advice.

WALMART TURBOTAX PREMIER 2018 PROFESSIONAL

Maximum Refund Guarantee / Maximum Tax Savings Guarantee - or Your Money Back: If you get a larger refund or smaller tax due from another tax preparation method, we'll refund the applicable TurboTax federal and/or state purchase price paid.100% Accurate Calculations Guarantee: If you pay an IRS or state penalty or interest because of a TurboTax calculation error, we’ll pay you the penalty and interest.Limited interest and dividend income reported on a 1099-INT or 1099-DIV.A simple tax return is Form 1040 only (without any additional schedules). TurboTax Free Edition: $0 Federal + $0 State + $0 To File offer is available for simple tax returns only with TurboTax Free Edition.The IRS will bill you for this it will not be calculated by preparation and e-filing for 2018 is permanently closed. If you owe taxes, the interest/penalties will be calculated by the IRS based on how much you owe and when they receive your return and payment.

If you are getting a refund, there is not a penalty for filing past the deadline. The IRS will bill you for this it will not be calculated by TurboTax. Read the mailing instructions that print with your tax return carefully so you mail them to the right addresses.

WALMART TURBOTAX PREMIER 2018 SOFTWARE

You may also want to explore purchasing the software from various retailers such as Amazon, Costco, Best Buy, Walmart, Sam’s, etc.įederal and state returns must be in separate envelopes and they are mailed to different addresses.

WALMART TURBOTAX PREMIER 2018 DOWNLOAD

If you need to prepare a return for 2017, 2018, or 2019 you can purchase and download desktop software to do it, then print, sign, and mail the return(s) The IRS will bill you for this it will not be calculated by preparation and e-filing for 2017, 20 is permanently closed.

WALMART TURBOTAX PREMIER 2018 FULL

Note: The desktop software you need to prepare the prior year return must be installed/downloaded to a full PC or Mac. Use a mailing service that will track it, such as UPS or certified mail so you will know the IRS/state received the return. When you mail a tax return, you need to attach any documents showing tax withheld, such as your W-2’s or any 1099’s. Remember to prepare your state return as well-if you live in a state that has a state income tax. If you need to prepare a return for 2016, 2017, or 2018 you can purchase and download desktop software to do it, then print, sign, and mail the return(s) Online preparation and e-filing for 2018 is permanently closed.

0 kommentar(er)

0 kommentar(er)